StaFi Protocol Product

StaFi App has been upgraded to the latest version. To learn more about the updates, please visit https://app.stafi.io/ (opens in a new tab).

This document is intended for users and developers who want to learn more about product developed by StaFi.

rToken App

rToken App (opens in a new tab) supports the staking features for following tokens: ETH(Ethereum), FIS(StaFi), BNB(BSC), MATIC(Polygon), ATOM(Cosmos), SOL(Solana), DOT(Polkadot), KSM(Kusama) and so on.

Users can easily deposit their tokens to a stake pool in the rToken App, just like swapping, and receive rTokens in return.

Pool

rPool (opens in a new tab) is a staking incentive program initiated by StaFi. Users who stake their tokens through the StaFi rToken App can participate in rPool and earn FIS tokens in proportion to their stake.

The incentive fee is paid in FIS (StaFi Chain Native Token). For example, in the rETH mint program, users who stake ETH will receive rETH, which represents their staked ETH. They will also receive FIS rewards, which are paid out in proportion to their stake. The total APR for staking ETH in the rETH mint program is the sum of the ETH staking APR and the FIS rewards APR.

Mint Program

The Mint Program is a staking incentive program that rewards users for staking their tokens in StaFi and minting new rTokens.

When users stake their tokens in StaFi, they receive rTokens, which represent their staked tokens. They also receive FIS rewards, which are paid out in proportion to their stake.

There is also another type of rToken program, which is called Liquidity Mining. In Liquidity Mining, users stake their rTokens to a liquidity mining contract. Their rTokens are locked, and they will receive FIS rewards in return.

The Mint Program and rToken Liquidity Mining are both designed to incentivize users to stake their tokens in StaFi and earn rewards. By staking their tokens, users can earn both rTokens and FIS rewards.

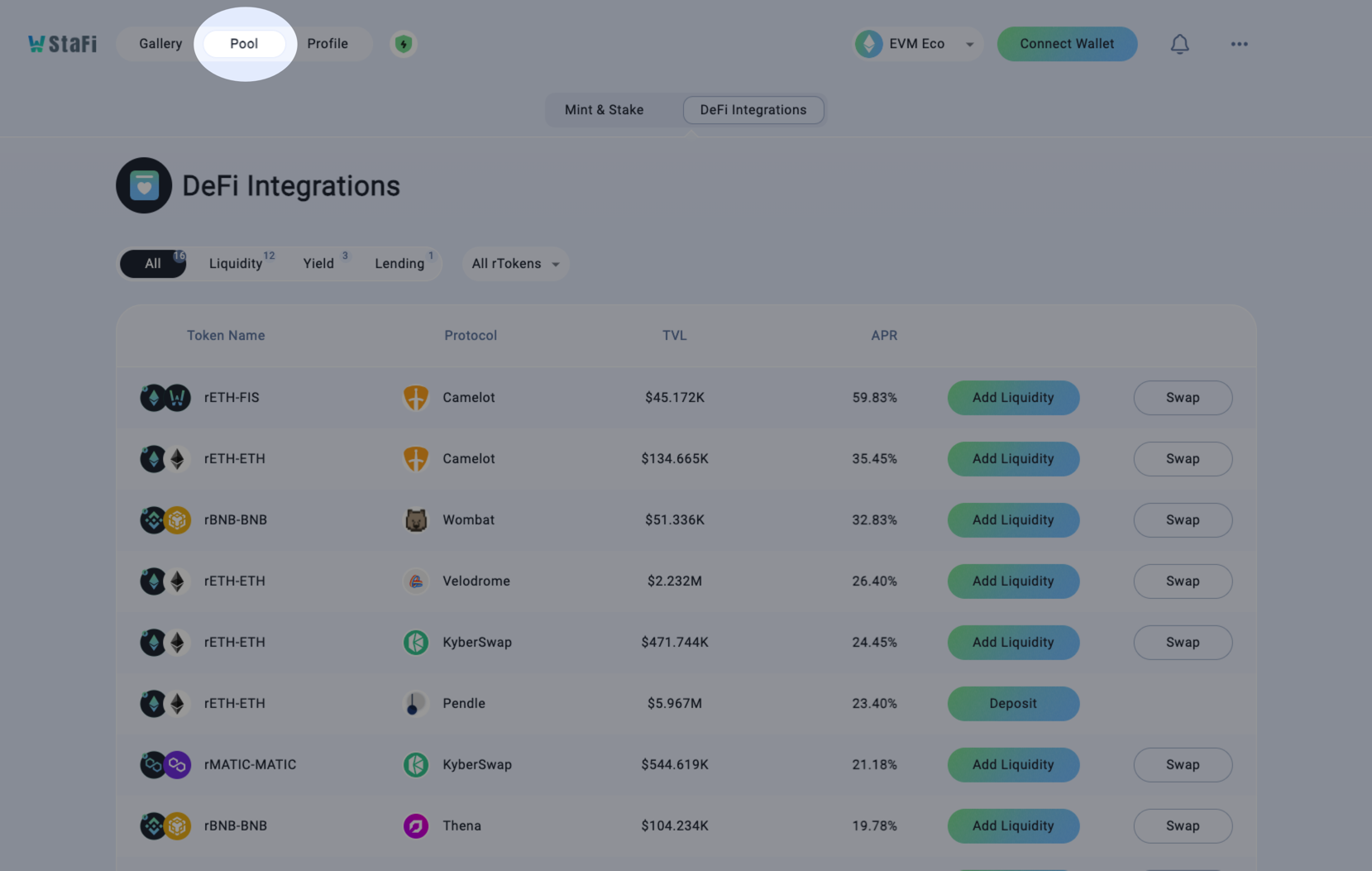

DeFi Integration

To increase the adoption of rTokens, StaFi will partner with many DeFi protocols.

StaFi will create pools in these DeFi protocols and use FIS as the pool incentive fee. This means that rToken holders can add their rTokens to the liquidity pools and earn rewards in FIS.

By partnering with DeFi protocols, StaFi can make rTokens more accessible to a wider range of users. This will help to increase the adoption of rTokens and the overall value of the StaFi ecosystem.

If you have any ideas for rToken integration, please post a topic in governance forum (opens in a new tab).

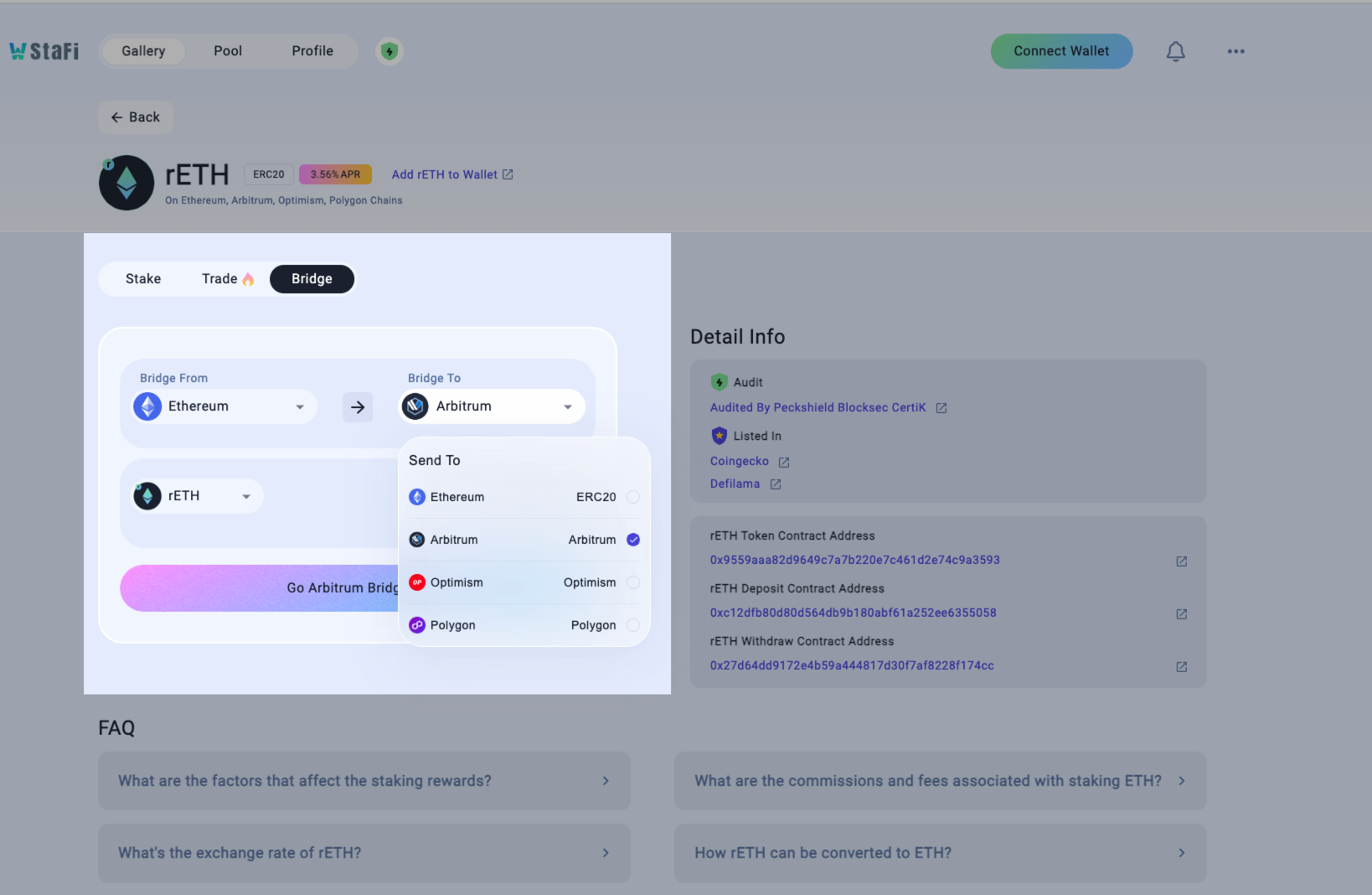

Bridge

StaFi initially used an appchain to implement staking, and rTokens were minted on the StaFi Chain. However, many DeFi applications are built on their original chains. To use rTokens in DeFi, users need to cross-chain them to the original chain. This is where rBridge comes in.

The Cosmos ecosystem is a multi-chain ecosystem, and StaFi Hub implements staking through parallel chains in the Cosmos ecosystem. rTokens are also minted on StaFi Hub and need to be cross-chained to the original chain using rBridge.

rBridge (opens in a new tab) is a cross-chain bridge that allows users to transfer rTokens between the StaFi Chain, StaFi Hub and the original chain. This makes it possible for users to use their rTokens in DeFi applications that are built on the original chain.

Asset

rAsset (opens in a new tab) is a dashboard product for rToken holders. It allows rToken holders to manage their rToken assets, including the amount of rTokens in their wallet, the total value of their held rTokens, and the number of redeemable native tokens.